Weekly Market Summaries

Week ending 27th June 2025

30th June 2025

Week ending 27th June 2025

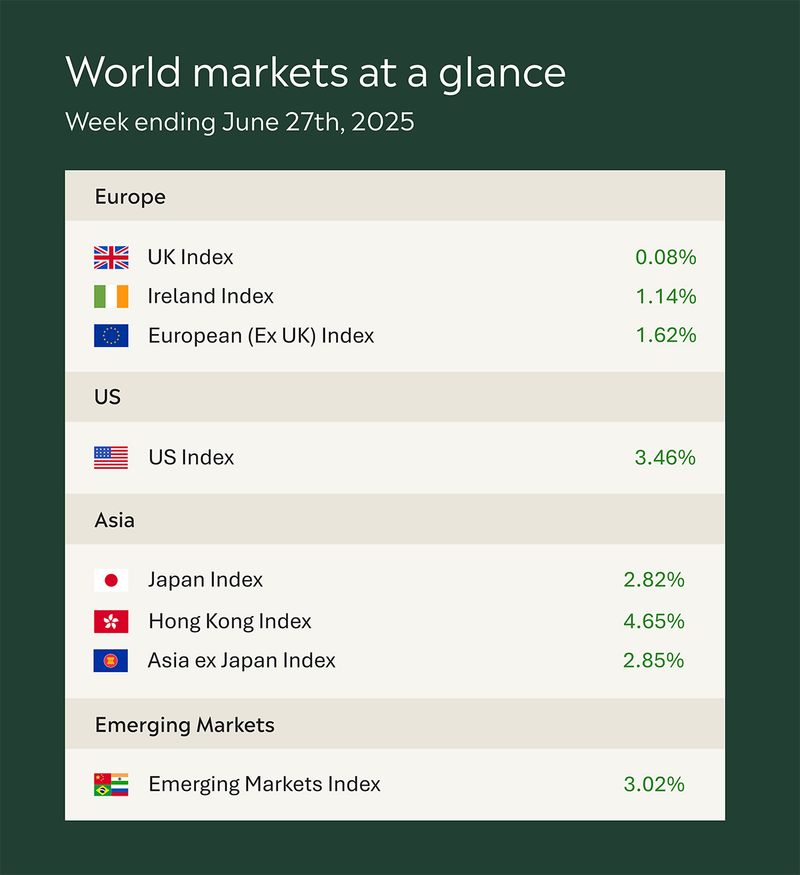

As you can see from the accompanying table financial markets wrapped up the week on a positive note and in some cases hit record highs.

Markets were lifted by a wave of optimism following news that the US and China have officially signed a trade agreement. While details remain light, reports suggest the deal includes progress on tech restrictions and rare earth exports. That was enough for investors, who welcomed signs that the world’s two largest economies are finding common ground after weeks of tension. Sentiment was further boosted after Donald Trump hinted at a possible separate agreement with India that could “open up” trade between the two nations. However, stocks pulled back from session highs after Trump said he was abandoning trade talks with Canada.

In the US, equity markets surged. The S&P 500 climbed 3.44% and the Nasdaq rose an impressive 4.25%, both closing at record highs. Market sentiment was further buoyed by dovish remarks from several Federal Reserve officials, indicating rate cuts could be on the table sooner than many have been anticipating.

US data showed the Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) price index, ticked slightly higher in May, rising 0.1% for the month and 2.3% year on year. The core PCE, which strips out food and energy, came in at 0.2% monthly and 2.7% annually, both a touch higher than forecast. While inflation remains above target, the modest increases are unlikely to shift the Fed’s policy stance dramatically in the near term.

Less welcome was the final read on Q1 GDP, which showed the US economy contracted by 0.5%. Consumer spending, slowed more sharply than previously estimated, rising just 0.5%. Still, markets largely shrugged off the data, focusing instead on trade developments and the possibility of easier monetary policy ahead.

Adding to the upbeat tone, geopolitical tensions in the Middle East appeared to ease with a ceasefire between Israel and Iran holding steady this week, offering a further boost to investor confidence. Oil prices also settled back down to where they were prior to escalations, Brent crude closing the week out at $66.77 pb.

Over in Europe, the STOXX Europe 600 Index rose 1.32%. The UK’s FTSE 100 edged up 0.28%, as global rather than domestic factors dominated the mood.

Mainland Chinese markets also posted strong gains on the back of the trade breakthrough, with investors welcoming the prospect of smoother US China economic relations.

Next week’s data highlights include Eurozone inflation, US ISM manufacturing and services, non-farm payrolls and the unemployment rate, as well as China’s manufacturing PMI.

Kate Mimnagh, Portfolio Economist